Peace of mind for all of your real estate assets

Guard Title is a national title insurance agency providing a full array of real estate transactional and title services for all asset classes.

Residential

Residential Made Easy

Commercial

Commercial Made Easy

National

National Coverage

National Coverage Across All Asset Classes

Single Family

Multi-Family

Condos

Mixed-Use

Commercial

Industrial

Residential

At Guard Title we understand the significance of homeownership. Residential title insurance serves as a crucial safeguard against unforeseen risks that could jeopardize homeownership. The comprehensive policies offered by Guard Title provide protection against various title threats, enabling clients to feel secure in their investment.

Working with Guard Title helps our clients alleviate the stress of a home purchase allowing them to focus on the transaction. Our commitment to providing a seamless and reliable service underscores Guard Title’s dedication to supporting clients throughout the homeownership journey.

The comprehensive policies offered by Guard Title provide protection against various threats such as:

- Hidden liens or claims against the property

- Errors in public records

- Fraudulent deeds or forgeries

Commercial

Guard Title recognizes the unpredictable nature of commercial real estate transactions. Commercial title insurance plays a critical role in safeguarding against title risks which can derail business plans and jeopardize investments. By offering comprehensive coverage, Guard Title provides clients with the assurance that their commercial property interests are well protected from:

- Hidden liens and encumbrances

- Title defects and ownership disputes

- Fraudulent claims and forgery

Guard Title’s dedicated team of experts meticulously identify and address potential title threats, ensuring our clients can make informed decisions with confidence.

This proactive approach helps to establish a solid foundation for commercial property investments, instilling peace of mind in clients as they navigate the complexities of the commercial real estate market.

Our customized quotes further demonstrates our commitment to tailoring services to meet the specific needs and requirements of each client, enhancing the level of confidence and assurance provided.

- Comprehensive coverage

- Financial security

- Reduced risk and peace of mind

- Trusted expertise

- Competitive rates

- 24/7 customer support

- Risk management resources

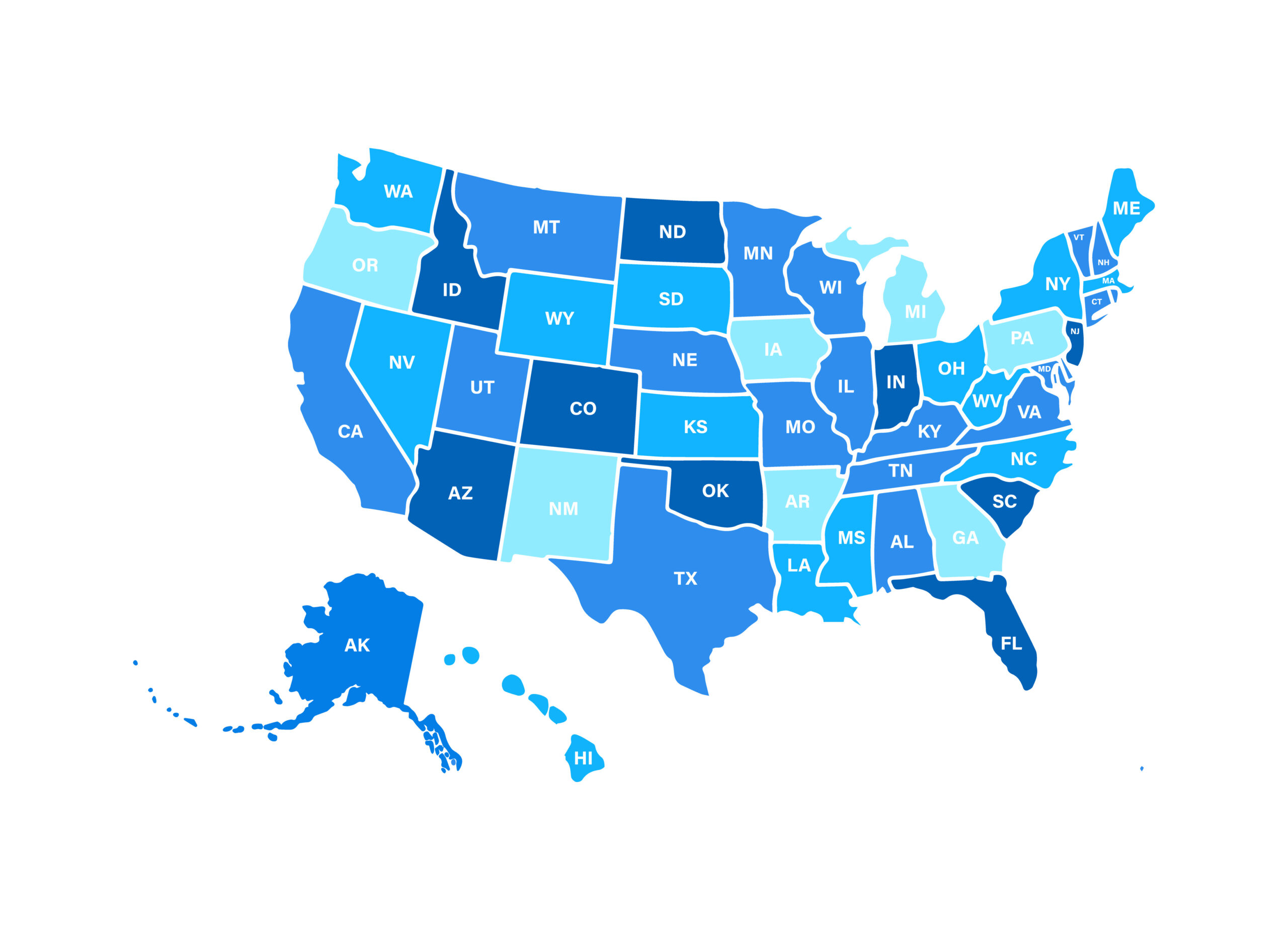

National

Nationwide Reach, Local Expertise: Our services span across the country and are available in all 50 states.

Residential

Sleep soundly knowing you're covered: Enjoy the peace of mind that comes with having a safety net against hidden risks.

Commercial

Financial security: Protect your bottom line with coverage for unforeseen events, ensuring business continuity and minimizing financial disruptions.

National

The All-American Advantage: From coast to coast, we offer seamless title services with the security of a national leader.

Testimonials

Take a look at what our customers have to say.

Buying a home was a whirlwind of emotions, but Guard Title provided a much-needed calm in the storm. Their website was transparent and informative, offering clear explanations of coverage options and their benefits. I could even get a personalized quote right on the spot! Throughout the entire process, the customer service was impeccable. Each representative I spoke with was knowledgeable, patient, and readily available to answer my endless questions. They even proactively provided additional resources and checklists to stay organized. Ultimately, Guard Title ensured the entire closing process felt smooth and secure. Knowing my biggest investment was protected by their comprehensive insurance gave me the peace of mind I needed to truly enjoy this monumental moment.

Jhon D.

Director of Acquistions

When I had questions about my title insurance policy, the Guard Title team was readily available and helpful. They explained everything in simple terms and made sure I understood my coverage. I highly recommend them

Laura Koi

Chief Legal Officer

Guard Title saved the day when a hidden lien turned up on the property I was buying. They handled everything quickly and efficiently, and I ended up closing on time and without any additional stress. I’m so grateful for their expertise!

Kathy Gullikson

Property Owner

“My dream of owning a home almost turned into a nightmare when a hidden lien popped up during the closing process. Panic set in, but then I remembered Guard Title. Their swift and decisive action was truly impressive. They immediately contacted the lienholder, investigated the situation, and kept me updated every step of the way. Thanks to their expertise and efficient negotiation, the issue was resolved within days, and my closing could proceed as planned. I can’t express enough how grateful I am for their professionalism and dedication. They went above and beyond, turning a stressful situation into a testament to the value of good title insurance. Knowing I have Guard Title by my side gives me immense peace of mind for the future.

David Rodgers

Real Estate Investor

FAQ

What is Residential Title Insurance?

Residential title, in the context of property ownership, can have two meanings:

1. Legal Right to a Dwelling: In its simplest form, residential title refers to the legal right to own and occupy a specific residential property. This includes houses, apartments, condominiums, and townhouses. The title is documented in a legal instrument called a “deed,” which outlines the owner’s rights and responsibilities.

2. Title Insurance Protection: More often, the term “residential title” is used in connection with title insurance. This is a type of insurance that protects homeowners from potential legal challenges to their ownership of the property. These challenges could come from various sources, such as:

- Hidden liens: Unpaid debts against the property by previous owners.

- Forged deeds or fraudulent claims: Someone else falsely claiming ownership.

- Errors in public records: Mistakes in property records causing ownership confusion.

- Boundary disputes: Uncertainties about the property’s exact boundaries.

Title insurance provides financial protection against these risks by covering legal fees and expenses incurred to defend your ownership rights. When buying a home, obtaining a residential title insurance policy is standard practice to ensure peace of mind and secure your investment.

In summary:

- Residential title can refer to the legal right to own a home.

- Title insurance protects homeowners from potential legal challenges to their ownership.

- Obtaining residential title insurance is recommended for new homeowners.

What is Commercial Title Insurance?

Commercial title refers to the legal right to own and occupy a property used for business purposes, such as office buildings, retail stores, factories, warehouses, or multi-unit apartment complexes. Similar to residential title, it’s documented in a deed specifying ownership rights and responsibilities.

However, commercial title is often more complex than residential title due to several factors:

- Zoning and permitting: Commercial properties have stricter zoning regulations and require specific permits for operation, adding potential legal complexities to ownership.

- Financing: Commercial properties typically involve larger financial transactions and more intricate loan structures, demanding greater scrutiny of the title’s legal status.

- Intellectual property: Some commercial properties may encompass unique assets like brand names or patents, which must be factored into the title to ensure proper transfer and protection.

- Environmental concerns: Potential environmental liabilities (e.g., contamination) associated with the property must be investigated and addressed in the title documentation.

To address these complexities, commercial title insurance plays a crucial role for owners and investors:

- Protecting against hidden liens and encumbrances: Similar to residential title insurance, it shields against hidden debts or claims on the property that could disrupt ownership.

- Mitigating title defects: It provides financial protection against legal challenges arising from errors or missing information in the title’s history.

- Enabling smooth transactions: It facilitates smooth closing by ensuring clarity and security of ownership for buyers and lenders.

In essence, commercial title is about securing your ownership of a business property and reducing financial risks associated with potential legal challenges. Obtaining comprehensive commercial title insurance is essential for anyone investing in or acquiring such properties.