National Title Insurance

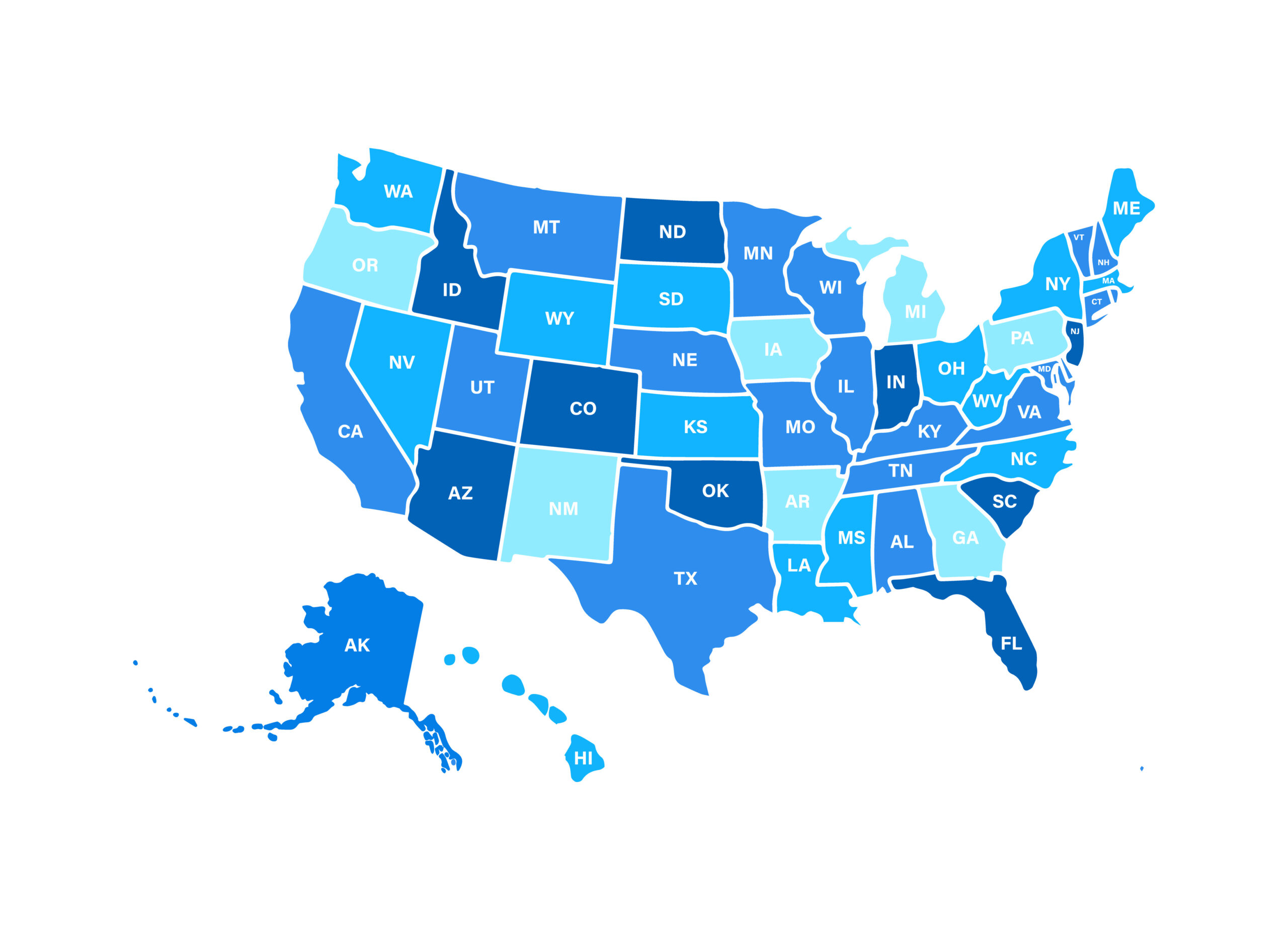

From the Main to Florida our team of national title advisors are here to help.

National Title Insurance

Local Expertise, Nationwide Strength: Our network of dedicated professionals ensures seamless transactions, wherever your real estate dreams take you.

- Streamlined Convenience

- Unwavering Support

- Simplify Multi-State Transactions

- Experience You Can Trust

- Peace of Mind, Anywhere

FAQ

What is Residential?

Residential title, in the context of property ownership, can have two meanings:

1. Legal Right to a Dwelling: In its simplest form, residential title refers to the legal right to own and occupy a specific residential property. This includes houses, apartments, condominiums, and townhouses. The title is documented in a legal instrument called a “deed,” which outlines the owner’s rights and responsibilities.

2. Title Insurance Protection: More often, the term “residential title” is used in connection with title insurance. This is a type of insurance that protects homeowners from potential legal challenges to their ownership of the property. These challenges could come from various sources, such as:

- Hidden liens: Unpaid debts against the property by previous owners.

- Forged deeds or fraudulent claims: Someone else falsely claiming ownership.

- Errors in public records: Mistakes in property records causing ownership confusion.

- Boundary disputes: Uncertainties about the property’s exact boundaries.

Title insurance provides financial protection against these risks by covering legal fees and expenses incurred to defend your ownership rights. When buying a home, obtaining a residential title insurance policy is standard practice to ensure peace of mind and secure your investment.

In summary:

- Residential title can refer to the legal right to own a home.

- Title insurance protects homeowners from potential legal challenges to their ownership.

- Obtaining residential title insurance is recommended for new homeowners.

What is Commercial?

Commercial title refers to the legal right to own and occupy a property used for business purposes, such as office buildings, retail stores, factories, warehouses, or multi-unit apartment complexes. Similar to residential title, it’s documented in a deed specifying ownership rights and responsibilities.

However, commercial title is often more complex than residential title due to several factors:

- Zoning and permitting: Commercial properties have stricter zoning regulations and require specific permits for operation, adding potential legal complexities to ownership.

- Financing: Commercial properties typically involve larger financial transactions and more intricate loan structures, demanding greater scrutiny of the title’s legal status.

- Intellectual property: Some commercial properties may encompass unique assets like brand names or patents, which must be factored into the title to ensure proper transfer and protection.

- Environmental concerns: Potential environmental liabilities (e.g., contamination) associated with the property must be investigated and addressed in the title documentation.

To address these complexities, commercial title insurance plays a crucial role for owners and investors:

- Protecting against hidden liens and encumbrances: Similar to residential title insurance, it shields against hidden debts or claims on the property that could disrupt ownership.

- Mitigating title defects: It provides financial protection against legal challenges arising from errors or missing information in the title’s history.

- Enabling smooth transactions: It facilitates smooth closing by ensuring clarity and security of ownership for buyers and lenders.

In essence, commercial title is about securing your ownership of a business property and reducing financial risks associated with potential legal challenges. Obtaining comprehensive commercial title insurance is essential for anyone investing in or acquiring such properties.